Toyota Tundra Depreciation

Some models it beat to the honor include the.

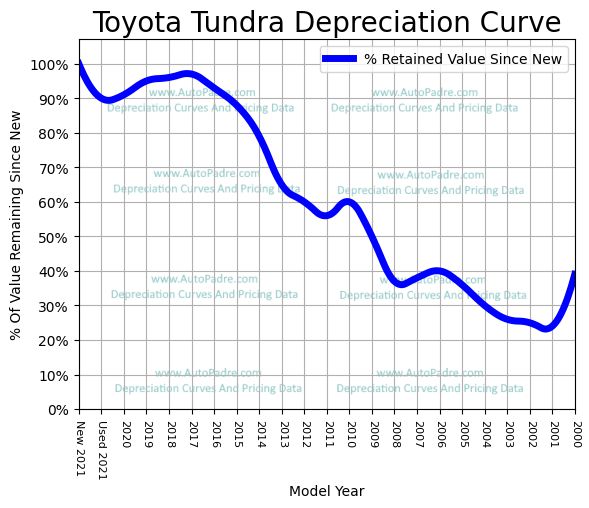

Toyota tundra depreciation. The Tundra also made iSeeCars list of top 10 vehicles with the lowest depreciation placing fourth. 2012 Limit on Capital Purchases 560000. Cost to own data is not currently available for the 2009 Toyota Tundra Double Cab-V8 Dbl 47L V8 5-Spd AT SR5.

Toyota vehicles have an average depreciation in the first three years from new of 35 percent. Select a Toyota from below to calculate depreciation for it. These 10 Vehicles Hold Their Value Better Than Most The vehicles that hold their value best over five years are those that dont change a lot from year to year.

2022 Tundra Hybrid Powertrain. In 5 years its value is expected to decrease approximately 8749 from its new price of around 22434 down to 13685. Toyota Corolla Depreciation Rate 5 Year Depreciation Rate A 2020 Toyota Corolla has a forecasted 5 year depreciation rate of 39.

Depreciation Depreciation is an estimate of the reduction in value incurred by owning and operating a vehicle over a period of time. Section 179 Deduction limit after adjustment for inflation has increased to 139000 maximum allowance would have been only 25000 prior to the new legislation. Toyota has earned a reputation for making trouble-free vehicles and that in turn is a big driver in high resale value.

The 2019 Toyota Tundra True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership. 31 Leveling Lift Kit 20X9 Fuel Assaults 1 29560R20 Falken Wildpeak AT3W. ISeeCars recently analyzed over 7 million new and used vehicles to determine which were the best and worst at retaining value.

2019 SR5 CM CEMENT GREY. Overall over a 5-year period the site found a vehicle loses 496 of its value to depreciation. Toyota is well aware that trucks have taken on the role of family hauler.